Trading Conditions

We provide the best trading conditions to our valued traders!

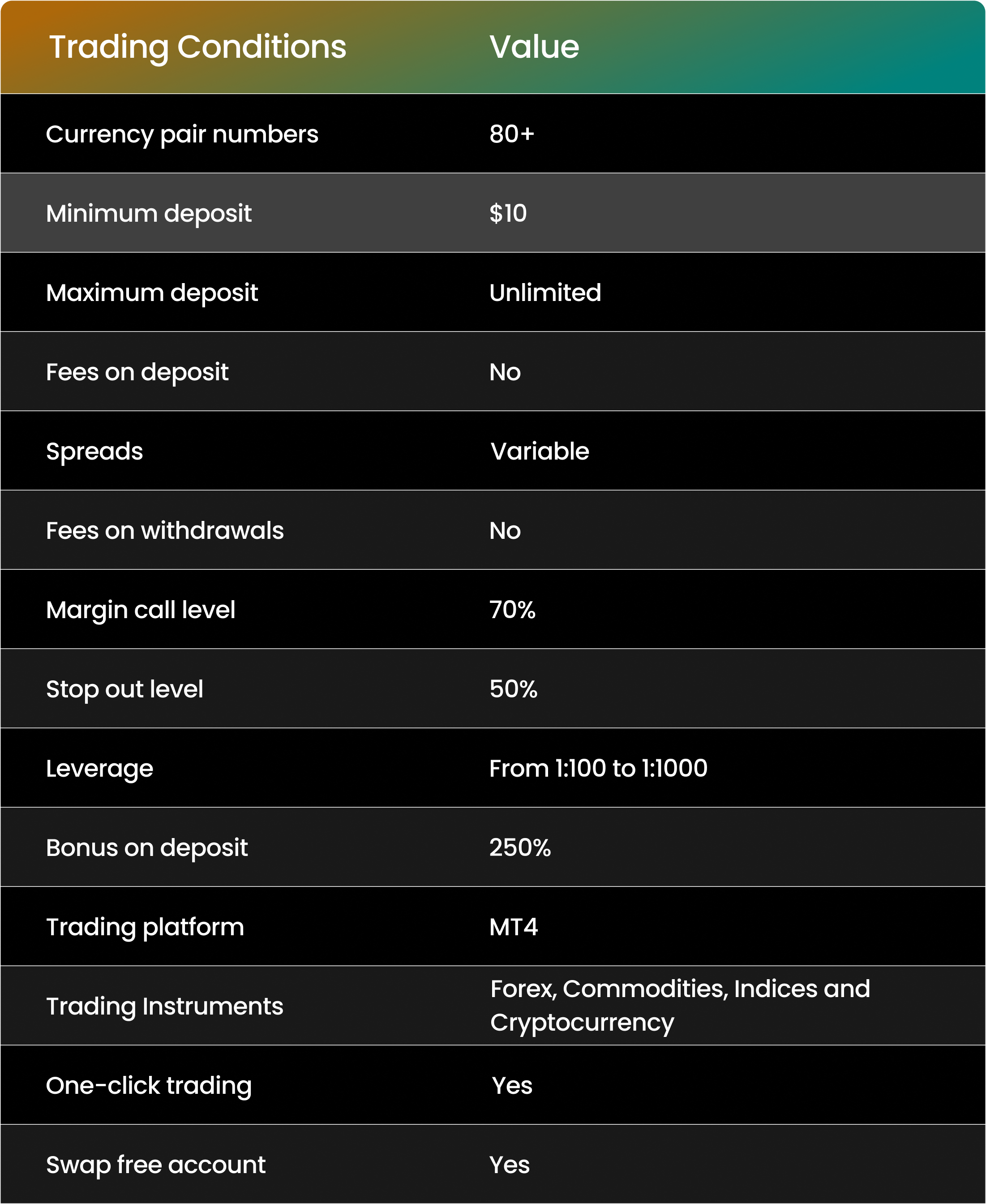

You can choose from our Zero, VIP, Standard Account and Swap-Free accounts, each offering distinct advantages depending on your experience and investment preferences. Pick the account that suits your trading goals and expertise level!

Essential Information

Spread

A spread in trading refers to the difference between the ask price (the price at which you can buy) and the bid price (the price at which you can sell) of a financial instrument like a currency pair or stock. It represents the cost of making a trade and is typically measured in pips for trading.

Leverage

Leverage in trading refers to the ability to control a larger position in the market with a smaller amount of capital. It allows traders to amplify their potential profits (or losses) by using borrowed funds from their broker. Leverage is typically represented as a ratio, such as 50:1, 100:1, or even higher, indicating the multiple of your trading capital that you can control.

Margin

Margin in trading is the amount of funds needed to open and maintain a trading position with a broker. It acts as collateral to cover potential losses. Expressed as a percentage, margin requirements vary based on instruments, broker policies, and regulations.

Margin Call Level

The margin call level is the point at which a broker requires a trader to deposit more funds into their account. It’s expressed as a percentage of the usable margin. If a trader’s equity falls below this level due to losses, a margin call is issued to add funds or close positions.

Stop-Out Level

The stop-out level is a predefined margin level at which a broker automatically closes one or more of a trader’s open positions to prevent further losses. It’s expressed as a percentage of the usable margin. If a trader’s equity falls below this level due to losses, the broker will initiate a “stop out,” closing trades until the margin level is above the stop out level.